child tax credit portal phone number

The Administration collaborated with a non-profit Code for America. Do not call the IRS.

Tax Tip Tool Available To Track Your Advance Child Tax Credit Payments Taxpayer Advocate Service

Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic.

. Information from previous benefit payments. Court approval letter or our IRS Form 56. 2021 Child Tax Credit and Advance Child Tax Credit Payments.

E-mail address or phone. The CTC was worth up to 3600 per qualifying child under 17. Resources and Guidance Understanding Your Letter 6416 or Letter 6416-A Understanding Your Letter 6417.

Telephone agents are available Monday to Friday except holidays from 900 am. The deadline to sign up for monthly Child Tax Credit payments is November 15. Our analysis ofthe Child Tax Credit.

Department of Revenue Services. Third parties calling for a deceased taxpayer. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

The Child Tax Credit helps families with qualifying children get a tax break. Already claiming Child Tax Credit. If you are calling the CRA on behalf of someone else you must be.

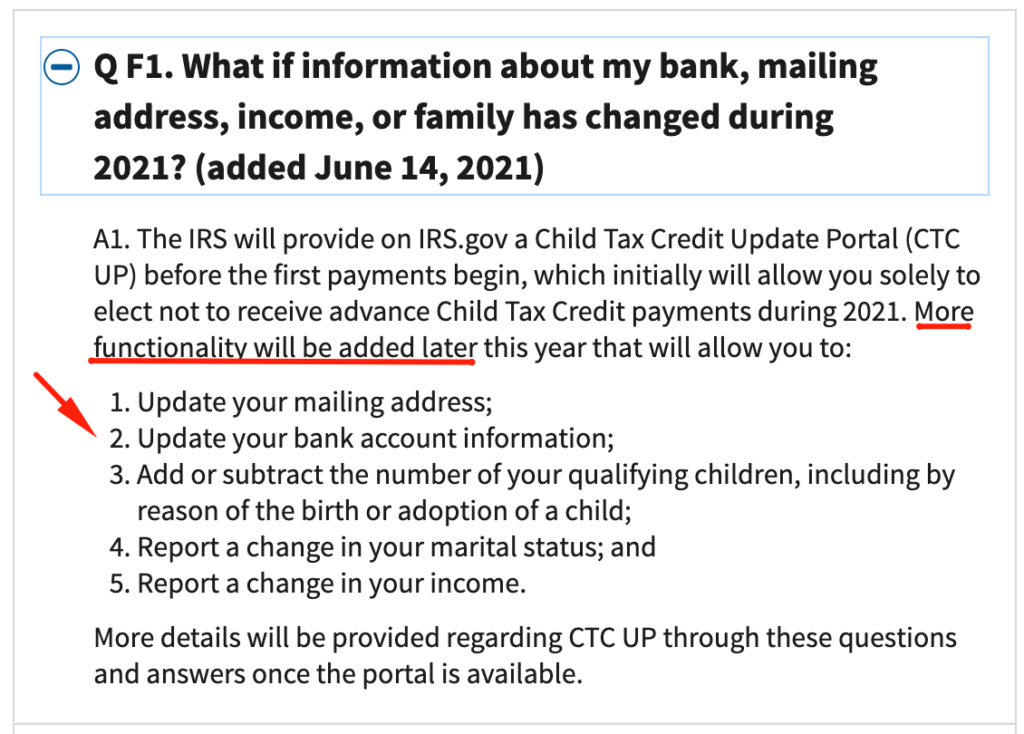

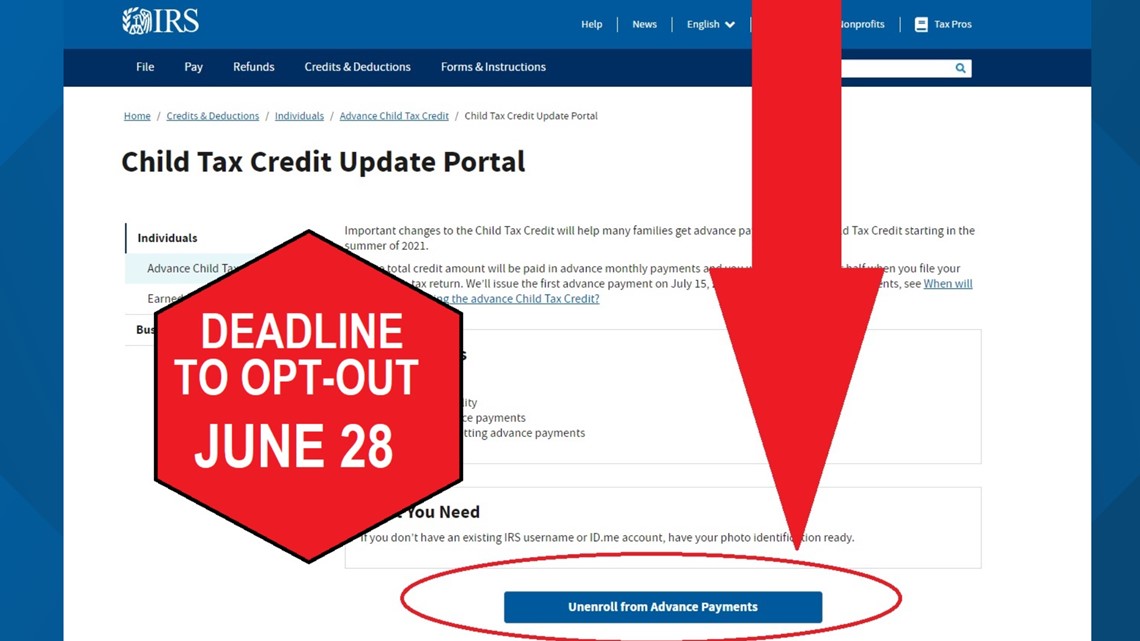

The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept. If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you. Do not use the Child Tax Credit Update Portal for tax filing information.

Preparer tax identification number or personal identification number. Our phone assistors dont have information. For example if you call the.

You can also use Relay UK if you cannot hear or speak on the phone. Instructions for Form 1040 Form W-9. Earned Income Tax Credit is calculated by the amount of earned income you received.

15 but the millions of payments the IRS has sent out have not. If you cannot use speech recognition software find out how to deal with HMRC if you need extra support. The amount you can get depends on how many children youve got and whether youre.

Individual Income Tax Attorney Occupational Tax Unified Gift and. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. Our automated services for the following benefits and credits are available 24 hours a day 7 days a week.

Personal details about the children in your care. Advance Child Tax Credit. The number to try is 1-800-829-1040.

For the September 30 2021 Advance. The Child Tax Credit CTC is a federal credit that helps families afford the everyday expenses of raising a child. Making a new claim for Child Tax Credit.

If you had an issue with a child tax credit payment that wasnt resolved there are a few ways to contact the IRS. Under a new law signed by President Biden on March 11 2021 individuals and families with children can get up to 300 per month per child under age 6. IMPORTANT INFORMATION - the following tax types are now available in myconneCT.

You may be able to claim the credit even if you dont normally file a tax return.

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

Child Tax Credit Payments Irs Online Portal Now Available In Spanish Nov 29 Is Last Day For Families To Opt Out Or Make Other Changes Larson Accouting

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Change Address On Child Tax Credit Update Portal Taxing Subjects

/cdn.vox-cdn.com/uploads/chorus_asset/file/22733126/1233995610.jpg)

How To Get The Child Tax Credit And Why It Should Be Easier To Get Vox

Child Tax Credit New Update Address Feature Available With Irs Online Portal Make Other Changes By Aug 30 For September Payment Linden Nj News Tapinto

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Biden Administration Reups Child Tax Credit Portal Politico

Child Tax Credit Irs New Online Portal Help Families Plan Ahead In Payments

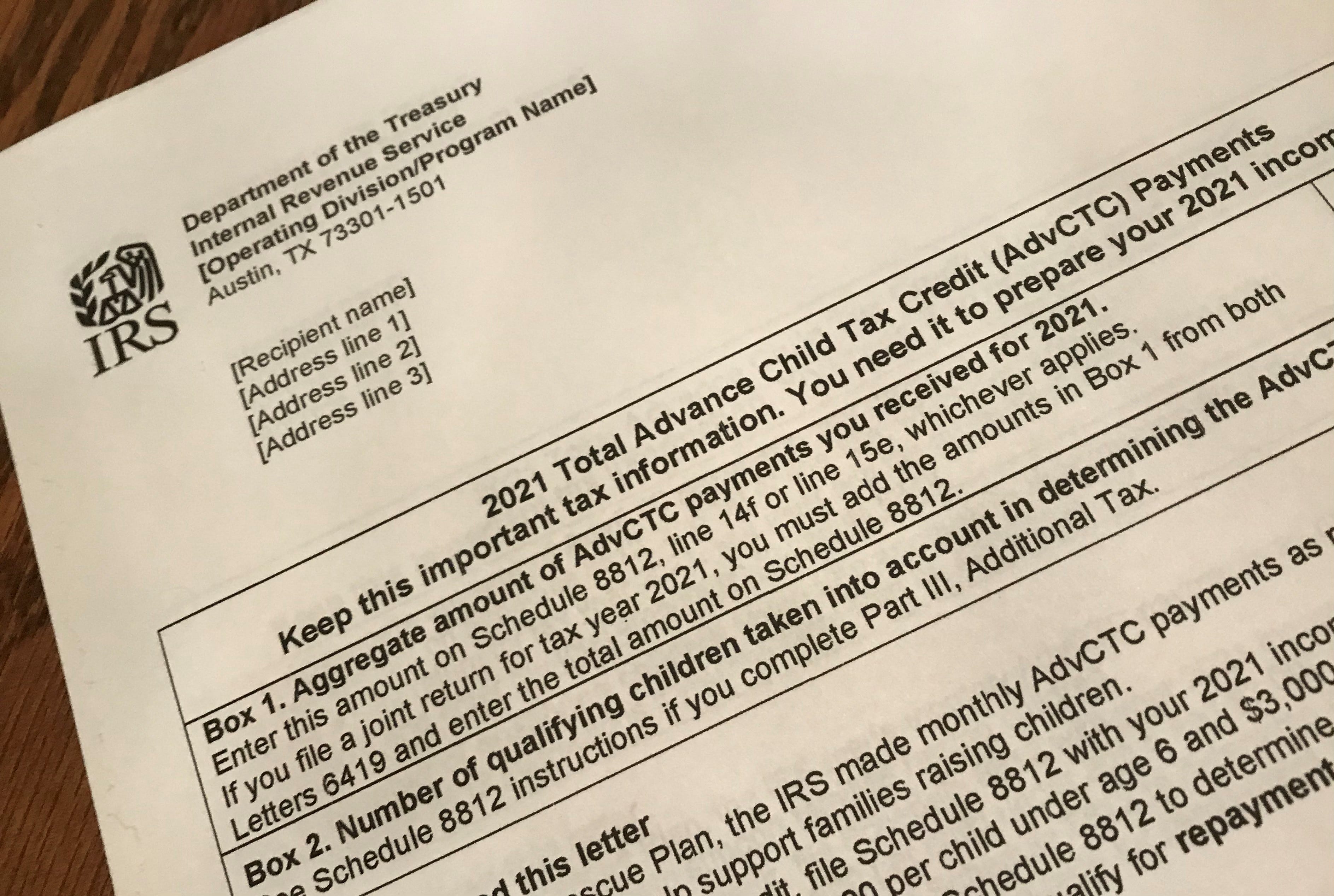

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

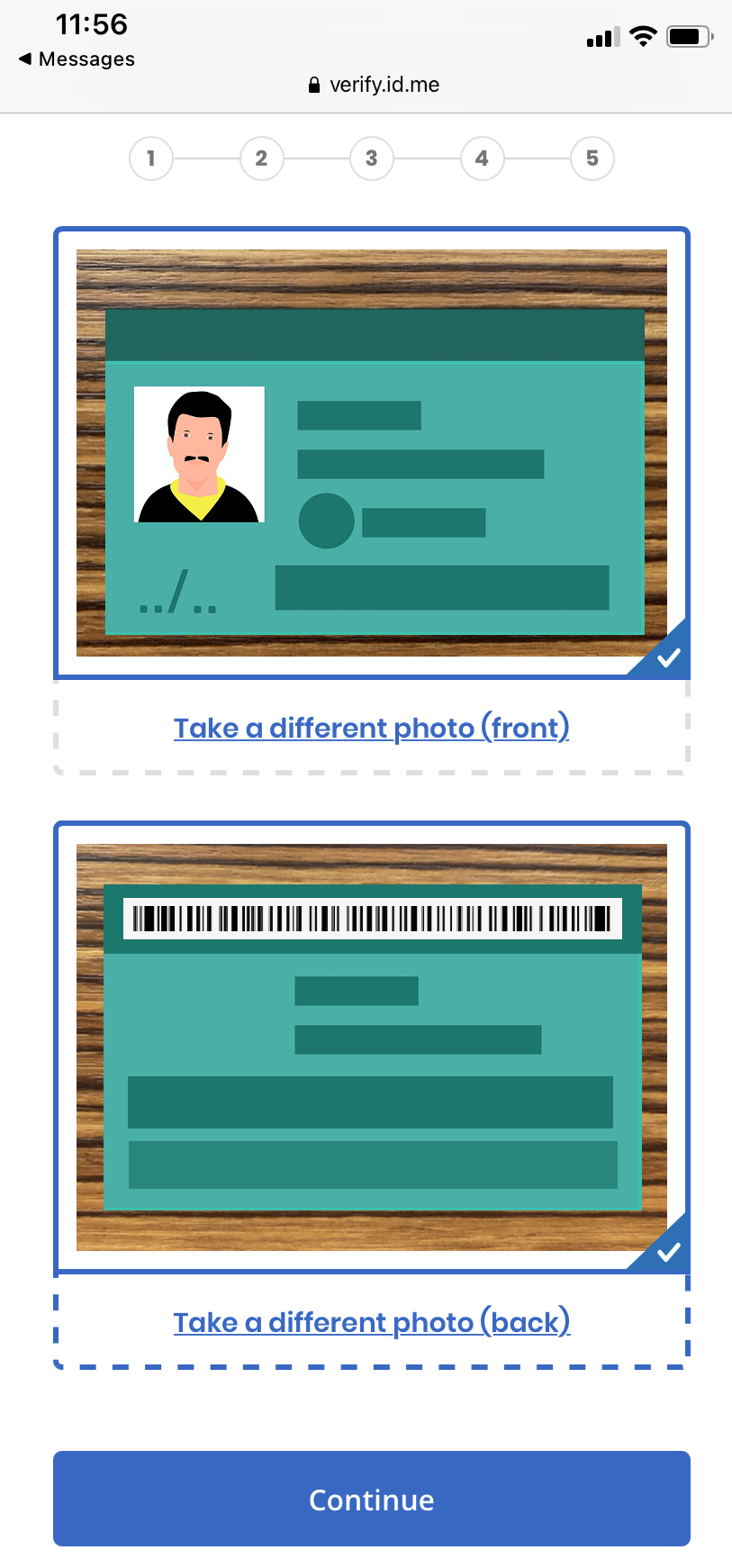

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Having Trouble Accessing The Child Tax Credit Portal Here S How To Sign Into Id Me Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Irs Is Shutting Down Its Child Tax Credit Portal For Now Best Life

H R Block Update Your Income In The Child Tax Credit Update Portal By Nov 29 To Ensure You Re Getting The Correct Amount Of Advance Ctc Payments During 2021 You Can Access