student loan debt relief tax credit 2020

But in Mississippi where the state tax code differs from the. If youre paying 400 a month in student loans which is over the.

Student Loan Forgiveness In Canada Loans Canada

The payments will not be.

. If you prefer to complete a hard copy application instead of applying online you may mail it to. Anyone who has continued to make student loan payments since the beginning of the payment pause in March 2020 might want to request a refund to make the most of any. Dont dump a loan application you currently started.

Individuals making less than 125000 and couples filing jointly making less than 250000 may receive up to 10000 in student debt cancellation and that maximum goes. In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria. Put another way.

If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. This application together with instructions that are related for Maryland residents who would like to claim the scholar Loan credit card debt relief Tax Credit. Lower interest rates loan forgiveness debt relief.

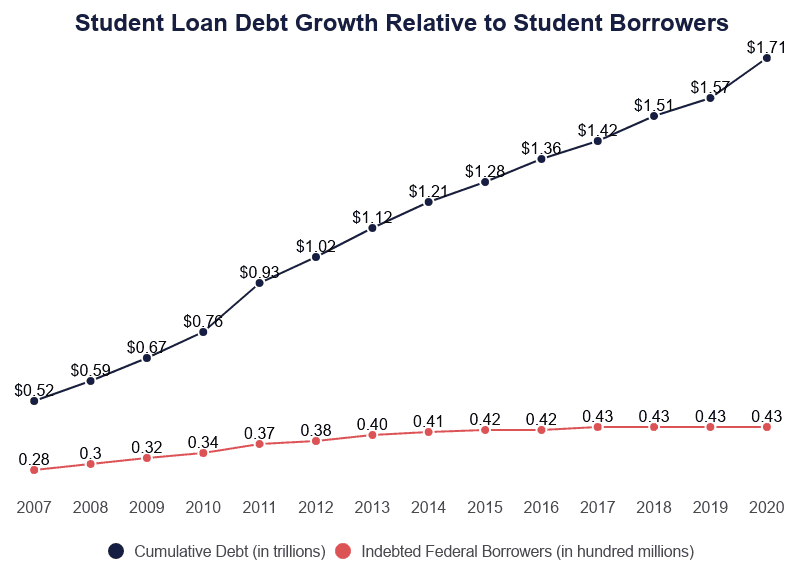

Give information on the. If youre paying 200 a month in student loans youll receive the following in credit. There are more than 45 million American borrowers who collectively owe nearly 16 trillion in student loan debt a burden amounting to nearly 8 of national income.

If the credit is more than the taxes you would otherwise owe you will receive. Employees must be a state. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

Beginning in the 2022 tax year employers will be provided with a 50 tax credit of up to 2625 per year for payments made on a student loan. Student Loan Debt Relief Tax. The maximum credit is 5000.

Maryland Higher Education Commission Attn. The Student Loan Debt Relief. President Biden Vice President Harris and the US.

Under the CARES Act employers can contribute up to 5250 toward a workers student debt on a tax-free basis through the end of 2020. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Complete the Student Loan Debt Relief Tax Credit application.

200 x 12 months 2400. From July 1 2022 through September 15 2022. On the federal level student debt relief is tax exempt until 2026 due to a provision in the American Rescue Plan Act.

Instructions are at the end of this application. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers transition back. 1 the Internal Revenue Service IRS will not assert that these taxpayers.

Student Loan Debt Relief Tax Credit Application. 2018-39 provide the following relief. Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details.

Can I claim the Student Loan Debt Relief Tax Credit. The government has loan forgiveness options for low-income borrowers but if you have a large amount of debt. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions. Will have maintained residency within the state of Maryland for the 2020 tax year Have. This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

What Are The Pros And Cons Of Student Loan Forgiveness

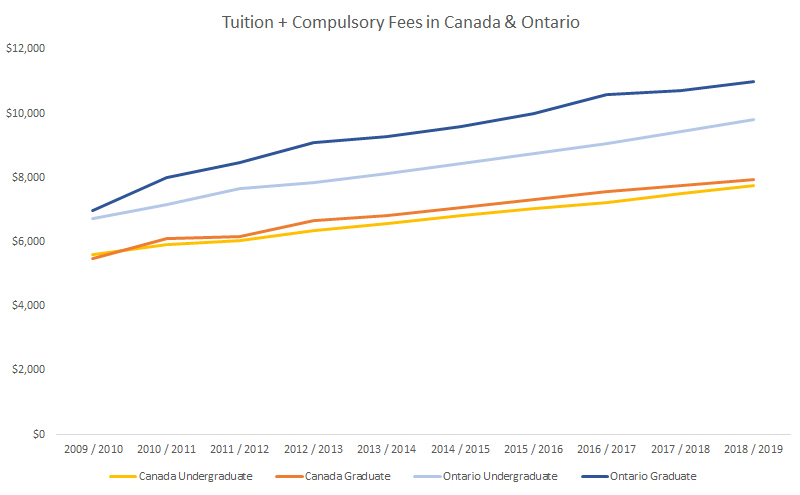

What Is The Current Student Debt Situation People S Policy Project

The Case Against Student Loan Forgiveness

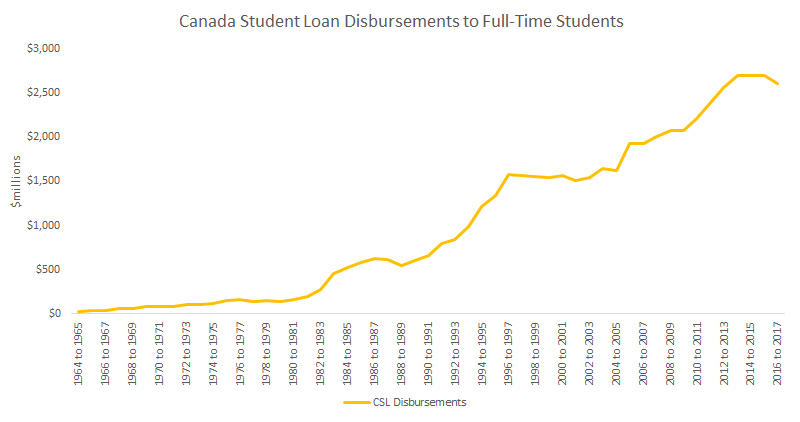

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

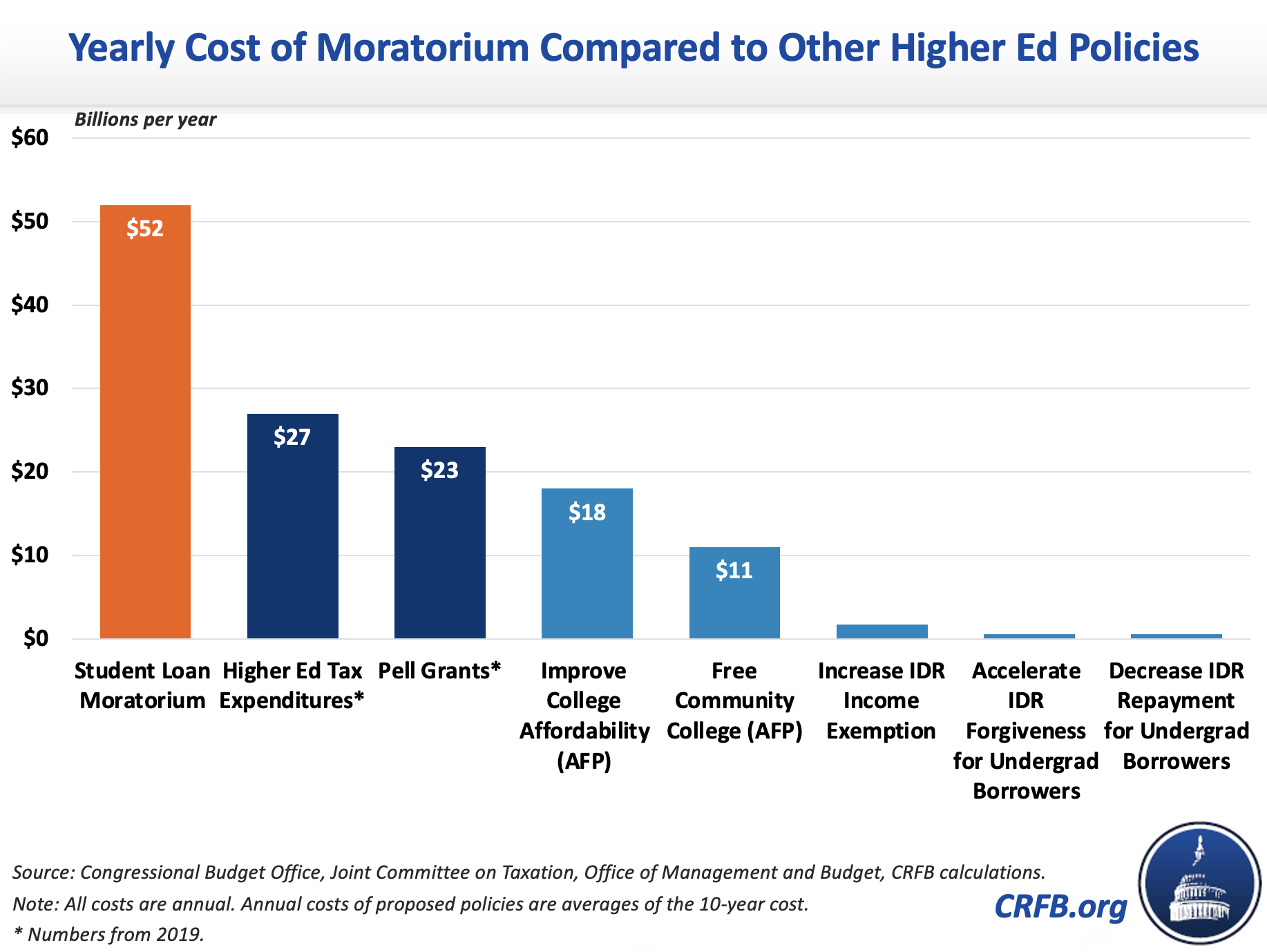

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

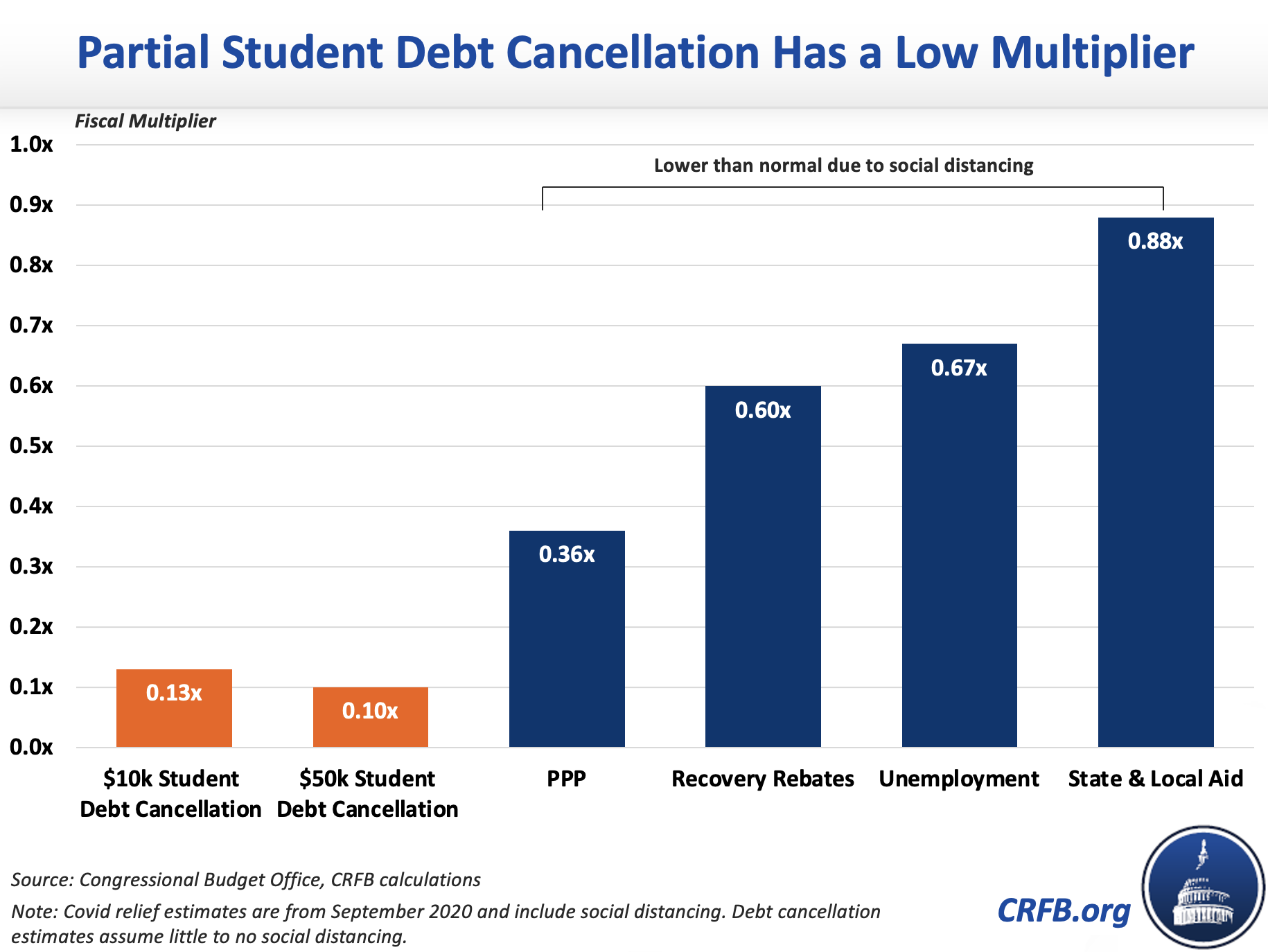

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

What Is The Current Student Debt Situation People S Policy Project

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

Can I Get A Student Loan Tax Deduction The Turbotax Blog

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Student Loan Forgiveness Statistics 2022 Pslf Data

Student Loan Debt Crisis In America By The Numbers Educationdata Org

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget